OmegA will take flight as early as 2021, Image Credit: Orbital ATK

At the 34th Space Symposium, Orbital ATK officially named their new rocket, previously known as the Next Generation Launcher, the OmegA. OmegA joins an increasingly crowded group of launch vehicles set to debut in the early 2020s. Does OmegA have what it takes to compete with these new vehicles, or does it represent the last attempt at an old paradigm?

What is OmegA?

OmegA is a new 'large-class' heavy launch vehicle. Its largest configuration has a payload to Geosynchronous Transfer Orbit (GTO -1800 m/s) of 10,100 kg and a payload to Geostationary Equatorial Orbit (GE0 ~35,786 km, 0 degrees) of 7,800 kg. These impressive payload numbers are a result of the high fuel-to-mass ratio of the carbon-composite solid rocket boosters that make up the first and second stages, as well as the cryogenic hydrolox propulsion system on the third stage.

The Intermediate Configuration (IC) is the version most likely to fly first, and most often. it still boasts an impressive 5,250 kg to GTO and 4,900 kg to GEO. The primary difference between each version is the first stage solid rocket motor. OmegA IC will use the Castor 600 solid rocket motor. It shares heritage with the Space Shuttle Solid Rocket Boosters but it brings in a few new innovations. Measuring 22m in length and 3.71m in diameter, the Castor 600 is roughly analogous to two segments of the Shuttle boosters. However, the carbon composite booster casing won't have seams between the segments, and will be immune to the same issue that caused the Challenger disaster, where hot exhaust gases seeped through the seam in a catastrophic failure. Switching from steel to composites will also increase the mass fraction of the rocket, contributing to the impressive performance numbers.

The Castor 600 and 1200 will be contiguous carbon composite casings. Image via Orbital ATK

The second stage of OmegA is common between variants and consists of a Castor 300 motor. This motor shares the same composite structure as the Castor 600 and 1200, but is roughly equivalent to a single segment of a Shuttle booster, at just 12.69m in length. By using similar manufacturing technologies across stages and reusing whole stages across variants, the final rocket could benefit from economies of scale. Both stages share a common core diameter of 3.71m.

The third stage of OmegA is very different from the rest of the rocket. It uses liquid propellants, liquid hydrogen and liquid oxygen, combined inside traditional rocket engines for thrust. The third stage leverages the long heritage of the RL10 engine to reduce development risk. The RL10 was the first hydrogen rocket engine produced in the United States and dates back to tests from the 1950s. Since then, it has become the workhorse engine of the Centaur upper stage, flying on Atlas, Titan, and Delta rockets. The RL10 even powered the Saturn 1 for 10 launches during the Apollo program. OmegA will use the the RL10-C, which features an entirely 3D-printed combustion chamber. The RL10-C1 has a specific impulse of 449.7 seconds. This gives the third stage incredible performance relative to its competitors. This also means the third stage can compensate for any under or over performance of the solid stages, since solid rocket motors cannot be throttled or easily shutdown in flight.

Can OmegA compete?

OmegA could be flying as early as 2021. However, the landscape of launchers will have changed dramatically by then. United Launch Alliance plans to phase out its entire launch vehicle line-up, including Atlas V, Delta IV, and eventually Delta IV Heavy as its own new rocket, Vulcan, takes over. Vulcan is designed to reduce ULA's launch costs by standardizing its production lines and incorporating elements of reuse using Sensible Modular Autonomous Return Technology (SMART). ULA believes reusing just the engines is cheaper than trying to recover the whole booster, and will still provide significant cost savings, since engines make up the bulk of a rocket's manufacturing cost. Vulcan will also eventually use the Advanced Cryogenic Evolved Stage (ACES), which ULA hopes will allow for a reusable, on-orbit system of payload tugs and 'distributed lift'. Vulcan's largest configuration also has a larger GTO payload capacity, up to 15,100 kg, which opens up the high-end of commercial satellites, government missions, and even interplanetary launches.

New Glenn is developing rapidly ahead of its 2020 debut. Image Credit Blue Origin

Stiffer competition may come from an upstart competitor: Blue Origin (BO). BO announced their partially reusable launch vehicle, New Glenn, in 2016. New Glenn is an all liquid propellant rocket, using the BE-4 methalox engine for its first stage, and recently switched to the hydrolox BE-3 engine for its second stage. These fuels have relatively high Isp, which offset the increased demands of landing. Also BO plans to return New Glenn at a barge at sea, avoiding the performance penalty of Return to Launch Site (RTLS) landings. In order to compete, OmegA needs to keep costs low while expending its solid booster stages. New Glenn is deep in development, with the factory exterior already constructed near Cape Canaveral, Florida, and significant testing of BE-4 underway. Orbital ATK says it can leverage its existing technologies and workforce to build OmegA, but BO is rapidly developing both of those things with the first launch targeted for 2020.

Another wildcard in the launch vehicle race is SpaceX. SpaceX has made massive strides in lowering the cost of access to space with its Falcon 9 and Falcon Heavy rockets. After an arduous development cycle, SpaceX launched Falcon Heavy (FH) earlier this year to much fanfare. While dual booster landings are visually impressive, FH's performance is impressive as well. FH can send up to 26,700 kg to GTO in fully expendable mode, and that is reduced to a still appreciable 6,400 kg in fully reusable mode. Reusing the whole booster stage keeps FH prices at ~$90 million per launch.

While the Falcon 9 and Heavy family look tough to beat already, SpaceX is not sitting on its laurels over the next three years. Elon Musk recently announced plans to experiment with second stage recovery. If these plans are successful, the price of Falcon family launches could plummet. SpaceX is already attempting to reuse the fairings, currently expended on each satellite launch. Closing the second stage gap would mean partial reuse schemes like SMART could not realistically compete.

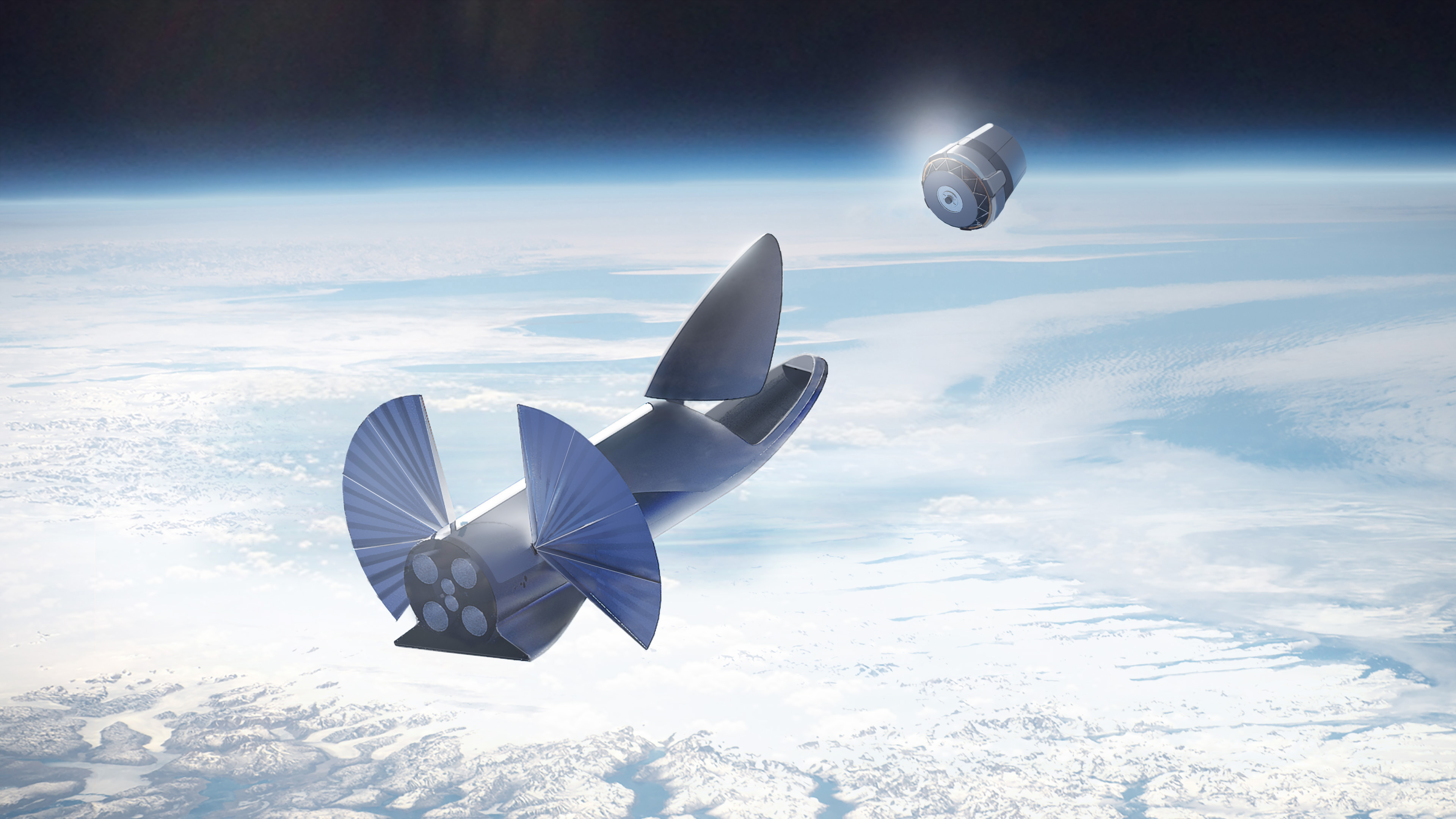

A cargo variant of BFR could redefine the launch market, right as these next-generation launch vehicles begin to stretch their legs. Credit SpaceX

The real wildcard is BFR. New Glenn, Vulcan, Falcon Heavy and OmegA all seek to compete in the heavy-lift market, launching commercial satellites for profit. BFR is a super-heavy lift launch vehicle, with complete first and second stage reuse. SpaceX hinted at a cargo variant of BFR in 2017. With a payload to LEO of 150,000 kg and on-orbit refueling capabilities, BFR has the lift and volume capacity to redefine what kinds of payloads the industry launches into space. the second stage of BFR, the Big Fucking (Falcon) Spaceship, already has tooling in production and is slated to begin test flights towards the end of 2019. It is unlikely BFR will fly before any of the previously mentioned launchers, but the debut of BFR in the mid 2020s could force these companies to reevaluate their approach.

Additional Reading

- Omega Fact Sheet

- Note: We have reached out to Orbital ATk regarding the payload figures in their documentation. We believe they may be mislabeled and have listed them in the article in logical order. If this is incorrect, we will update them when we get a response.